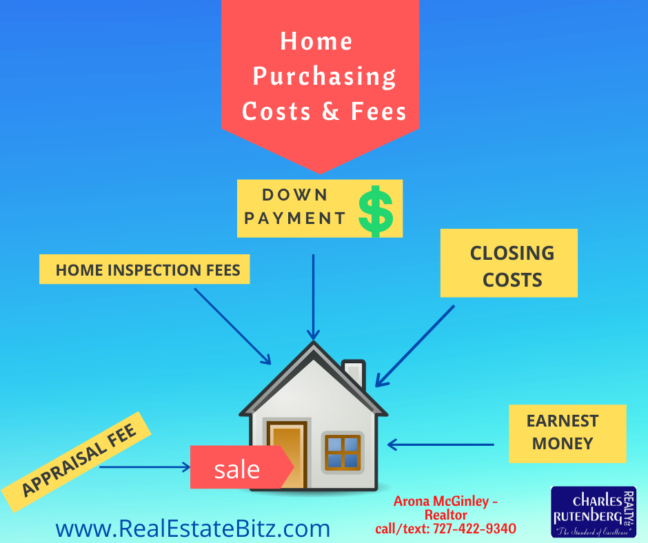

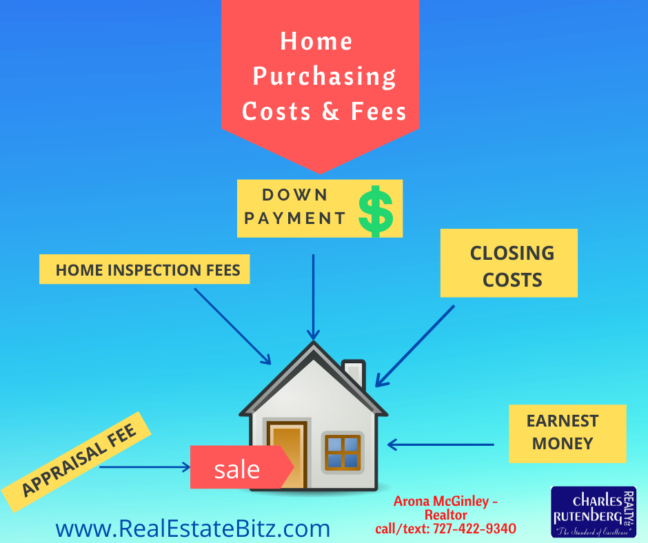

Here are some of the costs that you will have when purchasing a home in Florida.

Home Purchasing Costs & Fees

Real Estate In Tampa Bay Florida

RealEstateBitz is a combination of real estate articles and residential real estate being bought and sold in the Tampa Bay Florida Area.

buying real estate in florida

Here are some of the costs that you will have when purchasing a home in Florida.

Many of us think that the best time to sell a home would be in the spring and summer. This is true that the majority of buyers are looking to make a purchase during those months. But not all buyers disappear after Labor Day.

In Florida, your home may get a lot of interest from all the snow birds that are flocking down to Florida. This is a great time to take advantage of the holiday season and show off your home to 2nd home buyers or buyers that are looking to make Florida their home.

This is a great time to make your home look cozy and family friendly. Most people shopping for homes during the holidays are very motivated. This is great time to capitalize on this by creating an atmosphere of family with tasteful decorating and minimal clutter.

Show off your home’s greatest assets and enhance it by using tasteful christmas decorations.

Many sellers are debating on taking their home off the market during the holidays. You may find that you have little or no competition during the holidays. New sellers may want to wait for the new year to list their home or prefer to get it ready for sale during spring or summer.

This is an advantage to you because you have less competition for buyers looking for homes like yours. When you have less homes on the market it means that you get tons of buyers focusing on your home. Talk to your realtor and make sure your home is priced correctly.

Most people don’t decide to move during the holidays. If you have a buyer shopping for a home during the holidays usually it means they have to move. This involves a job or other reason to buy a home during the holidays. People shopping for homes around the holidays tend to be serious buyers and are very motivated. Keep the holiday cheer on when you meet with these folks and you’ll be sure to sell your home.

In order to use an FHA loan to purchase a home, the property will have to be appraised and inspected by a HUD-approved appraiser. This is to ensure that the property meets HUDS’s minimum property standards.

WHAT IS AN APPRAISAL?

Only an expert can assesses or determine the value of your home. You get an appraisal to determine the value of your home in today’s market. The appraiser usual has a check list of HUDs requirements for FHA.

Things You Should Know About FHA Home Appraisals

These are just some of the things that will be addressed with an FHA Appraiser. To get more information visit FHA APPRAISAL

If you are looking for more information on selling or buying a home please call/text 727-422-9340 or email: arona.mcginley@gmail.com or fill out the contact form.

This can be one of the most difficult part of the selling process for most homeowners. This is the home that you may have raised your family in and with that comes all the memories. How can you put a price tag on that? If you are selling by owner then it’s up to you to figure out what will be a fair price.

Take a look at your home and realistically write down the square footage of the home, number of bathrooms and bedrooms, any updates, example maybe you added a new roof, new kitchen or bathroom remodel. These things will be important when comparing your home to ones that have sold in your area. If your price is too high you may find that your home will sit on the market for months and if it’s too low, then you end up losing money.