Many of us may buy and sell a home maybe once or twice in our lifetime. This is one of the biggest investments that we will make so why leave it to chance. I know many of the DIYs are thinking I can do this job, this is a piece of cake. I can put my listing online and I can get a bunch of great offers. This is a common way of thinking for the average homeowner.

Don’t Make This Mistake

A homeowner may not know the value of their home. They either, undervalue it which they can potentially lose more than what they would have spent on hiring a Realtor who would have priced it correctly. On the flip side, we have the FSBOs that think their home is worth a lot more than it actually is.

Homes that are over-priced tend to sit on the market and get stale over time. Most people would not even call because they think that something is wrong with the home if it’s been on the market that long without a sale. It really isn’t an advantage, having your home sitting on Zillow for over 90 days. Don’t make the mistake of doing this.

Realtors know that homeowners are honest and hardworking people. We want to do our best to sell your home and get you as much as we can in the shortest period of time. We are there to be the buffer, to negotiate for you and your family, to do all the dirty work so you can get the benefit of a stress-free transaction. We strive to make your life remain as normal as possible during this whole process of selling your home.

Keep in mind

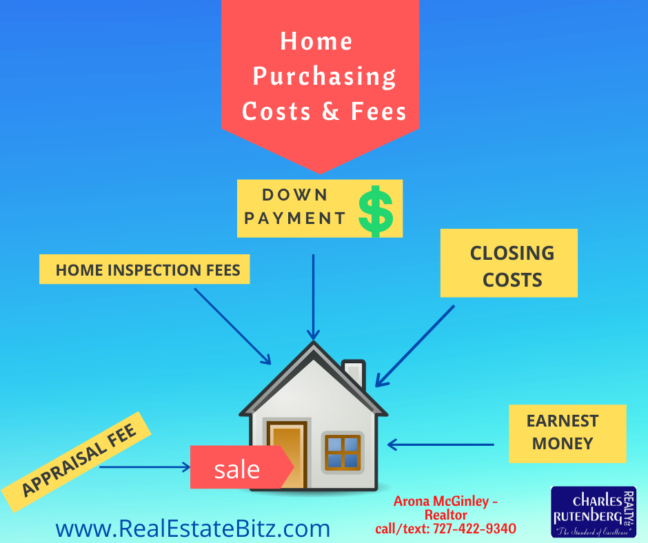

Your home will sell for what it is appraised at. It does not matter if you think your home is worth $20,000 more. It’s what the appraiser thinks it’s worth. Get a Comparative Market Analysis (CMA). Some Realtors will do this for free for you, so ask for one.

Tip: If you know you don’t like

- answering the phone, and talking to strangers

- is not available to show your home during the day or evenings

- cannot do open houses

- hate to negotiate with people

- already busy with family life (school, sports, work, kids)

- not computer savvy

- can’t take good photos

Don’t attempt to sell your own home. You are better off using a Realtor to help you sell your home. Call me if you are selling your home in the Tampa, Seminole, Largo, Clearwater, Pinellas Park, Tarpon Spring, Palm Harbor areas. I am an agent in Pinellas County Florida and can answer any questions you may have about selling your home.

Call/Text: 727-422-9340 Email: arona.mcginley@gmail.com

GET A COMPARATIVE MARKET ANALYSIS —IT’S FREE!