Sell Home in Florida

Selling a home in Florida involves a series of steps that are similar to selling a home in most other states. Check out this general outline of the process:

- Choose a Real Estate Agent: While you can sell your home on your own (For Sale By Owner or FSBO), working with a real estate agent can help streamline the process, market your property effectively, and negotiate on your behalf.

- Set the Right Price: Your real estate agent will help you determine a competitive and realistic asking price for your home. This involves looking at comparable sales (comps) in your neighborhood, considering the condition of your home, and factoring in the current real estate market conditions.

- Prepare Your Home: Make necessary repairs, clean, declutter, and stage your home to make it as appealing as possible to potential buyers. Curb appeal is crucial, so pay attention to the exterior as well.

- Market Your Property: Your agent will create a marketing plan to showcase your home to potential buyers. This can include professional photography, online listings, open houses, and more.

- Negotiate Offers: When you receive offers from potential buyers, your agent will help you negotiate the terms of the sale, including price, contingencies, and the closing date.

- Accept an Offer: Once you’ve agreed on the terms with a buyer, you’ll sign a purchase agreement. This legally binds both parties to the terms of the sale.

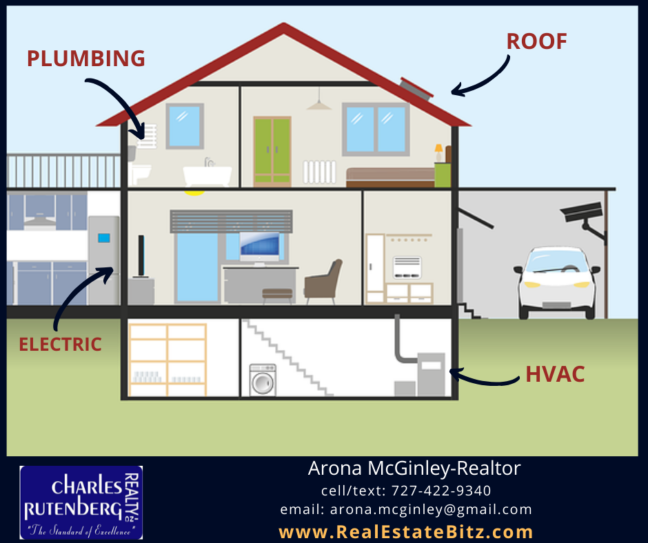

- Inspections and Appraisal: The buyer may request a home inspection and an appraisal. The inspection identifies any issues with the property, and the appraisal determines the home’s value. Depending on the outcomes, negotiations might continue.

- Title and Escrow: The title company or attorney will research the property’s title to ensure there are no liens or legal issues. Escrow is opened to hold the buyer’s earnest money and coordinate the closing process.

- Closing Disclosure: The buyer will receive a Closing Disclosure, which outlines the final terms of the loan, including closing costs and monthly payments. This must be reviewed and signed by the buyer.

- Closing: During the closing, both parties sign the necessary paperwork to transfer ownership. The seller provides the keys and the buyer provides the funds. The title company or attorney will facilitate the transfer of funds and ownership documents.

- Move Out: After the closing is complete, you’ll need to move out of the property and hand over the keys to the new owner.

- Post-Closing Details: Ensure all utilities are transferred to the new owner, cancel any homeowners’ insurance, and handle any final paperwork or details.

It’s important to note that real estate transactions can vary based on individual circumstances, local regulations, and market conditions. Working with a qualified real estate agent who understands the Florida market can be invaluable in navigating this process smoothly. Always consult with professionals, such as real estate agents and attorneys, to ensure you’re making informed decisions.

Call me Arona for more information on selling or buying your home.