Contingencies are things that a buyer can request that must happen in a set period of time in order for the real estate deal to go through.

Some common contingencies are: Inspection Contingency, Appraisal Contingency, and Finance Contingency.

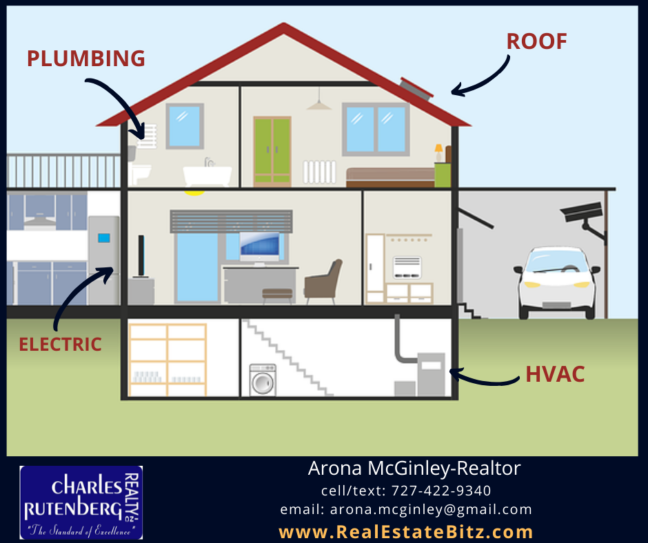

Inspection Contingency – A buyer can back out of the contract if an inspector finds too many problems or issues with the home.

Appraisal Contingency – This goes into effect if the house appraises for less than the offer contract amount. For example, the contract amount is $500,000 but the appraisal came back at $450,000.

Finance Contingency– The buyer has the option to back out if they cannot secure a mortgage.