You have found a home in your favorite Florida neighborhood that fits all your needs, and you decide you want to make an offer.

How do you make a strong offer on a home?

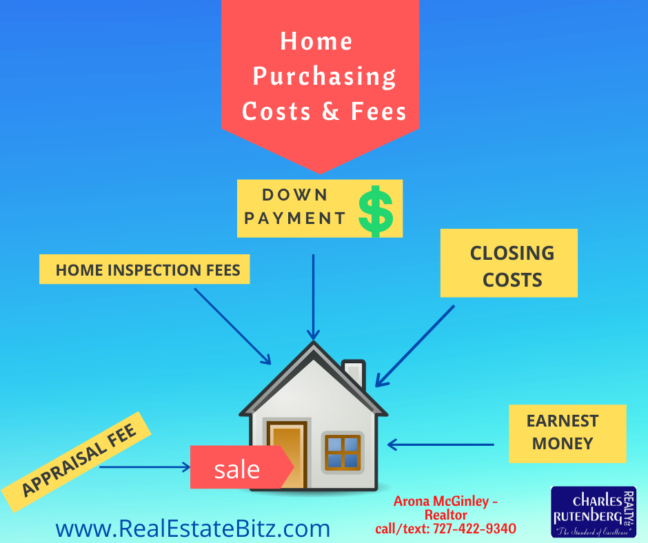

A strong offer is an offer that can be 5% less than the listing price usually. In today’s market with so few homes available for sale it may be in your best interest to go strong with a full price offer or 2% less than the listing price. When you make your offer you also want to show the seller that you are serious by submitting your pre-approval letter with your offer. Make it sweeter by putting down a healthy earnest deposit maybe around 1% of the sale price. Add some cash to the deal. Sellers like shorter inspection periods, that would be attractive to a seller. You can also offer the sellers a quick closing. (contact a realtor to help you with this step)

A Counter Offer

What is a counteroffer? Normally your first offer may not get accepted. There may be a counter-offer from the seller and you will need to respond to it when it is presented. You can either accept the counteroffer or go back with another offer, if that’s not accepted you can walk away from the home.

Why use a Realtor when making an offer?

In today’s market, it’s very competitive and you need someone that is looking out for your interest. The sellers have their agent and the buyer should have their own agent to help them with making the offer and negotiating for them. Don’t go house shopping without your Realtor, you could end up paying way too much for that home.