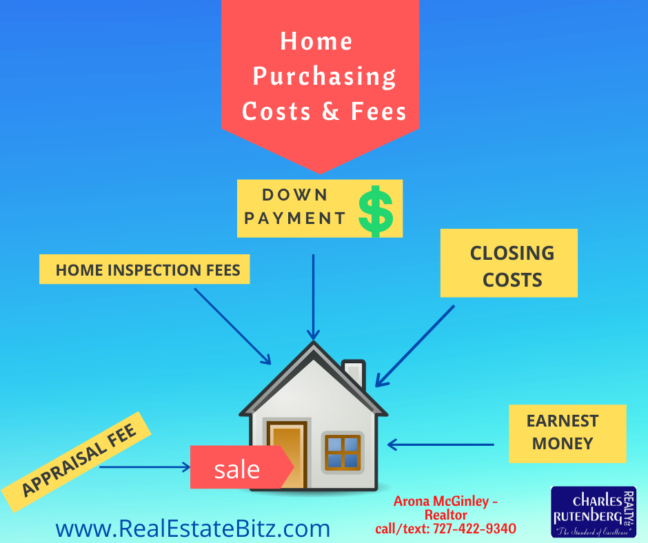

Did you know that the appraisal can make or break your real estate sale? The appraiser works for the bank, not the seller or the buyer.

In real estate transactions, we have 3 significant players – the buyer, the seller, and the lender. The Appraiser is the eyes of the lender in the field. An Appraiser plays a vital role in every real estate transaction.

For example, we have a real estate transaction of a sale price of $300,000. The buyer is putting 10% down which is $30,000. He is getting a loan in the amount of $270,000. Everyone so far thinks this home is worth $300,000, obviously, the buyer thinks this because he made an offer for the sale price of $300,000.

The lender now sends the Appraiser out to the home to get an appraisal of what the home is worth. Here is where it can become pretty tricky. When the appraiser goes out here are a few things that can happen:

- The appraiser determines that the value of the home is higher than the sales price, maybe its $305,000 instead of $300,000. This is great news because we can go ahead with our transaction.

- The appraiser, appraisers the value of the home at $300,000 which is the sales price. Excellent! We move ahead with the transaction.

- The appraiser values that home lower than the sales price for example $290,000. This becomes a problem for all parties involved. A couple of things can happen here which is not so great for the parties involved.

- The Lender can still lend the buyer the money to purchase the home but only for $290,000, not the $300,000 sale price.

- The seller can either eat the $10,000 and sell the home for $290,000 instead of $300,000. This can sometimes happen, where the seller comes down to the new appraisal price.

- The buyer can buy the home at $300,000 but would have to bring additional money to the table. You can see this happening in a seller’s market. The loan is now $290,000 with a down payment of $29,0000, the loan amount would be $261,000. The buyer has to bring an extra $10,000 to purchase the home at $300,000.

- The last thing that can happen is that the whole transaction blows up because neither party is willing to negotiate.

You can see how the Appraiser is vital to a real estate transaction. It does not matter what the buyer or the seller thinks the home is worth. It matters what the Appraiser thinks…that’s what counts!