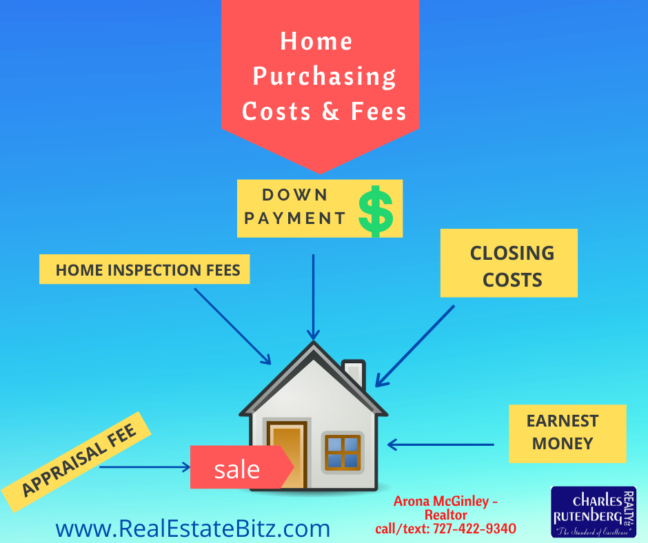

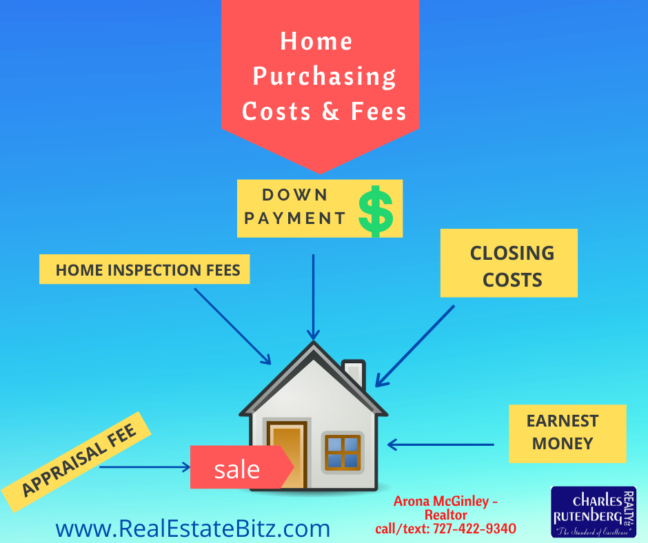

Here are some of the costs that you will have when purchasing a home in Florida.

Home Purchasing Costs & Fees

Real Estate In Tampa Bay Florida

RealEstateBitz is a combination of real estate articles and residential real estate being bought and sold in the Tampa Bay Florida Area.

Buying a home is the Tampa Bay Florida area is one of the smartest decisions you can make. In Tampa we are surrounded by sand and sea. We have the best of both worlds when it comes to stress free living. There is so much to do in Tampa. Looking for a Home in Tampa florida contact Arona a local realtor. Phone 727-422-9340. Click Here

Here are some of the costs that you will have when purchasing a home in Florida.

Buying a home can be the most exciting time for you and your family. But don’t lose out on the home of your dreams by doing this alone. This is one of the biggest financial transactions of your life, and I want to help you by making this experience less stressful.

As you go through the process you may have questions on –

There are so many things to think about when buying your home. Don’t go through this alone. Call/Text 727-422-9340 I can help you buy the dream home for you and your family.

You’re ready to sell your home, and although you’ve always kept your home in great condition you still need to do some extra maintenance. When selling your home your property has to be in tiptop shape if you’re going to get top dollar when you sell. If you’re selling your home you still want to have your home looking good on the inside as well as the outside. Even if your home is on the market for 3 months or more, you have to keep giving that home your love, even if you have already vacated the home. When your home looks like its well cared for, you get more people interested in looking at it and even get top dollar. Here are some tips that you may already be doing or neglecting.

Get your punch list made up, and make sure you’ve got all of these little things taken care of. By doing these small things you can get more return on your investment.

Florida is listed as the number one vacation destination. If you have extra cash this would be a great place to invest in a second home or even a home that you can rent out and make some extra cash.

There are many reasons that Florida is so attractive

When considering to purchase your home you will first have to consider what is your intention or the purpose of this home. If you are a snowbird then you will be using your Florida home during the winter months, and you can rent it out during the summer to friends, family or vacation goers. Are you planning on using a maintenance company to oversee everything? Is the income from the rental important, for example, will it be helping to pay the mortgage. These are things you will want to consider if you plan on using your home as a rental.

Some counties and cities have certain rental restrictions. Consider these rental restrictions when searching for an investment property. Some areas have restrictions such as rental agreements that can be no less than 30 days. These restrictions can affect how much rental income you can earn.

If this is an investment property you want to consider a location that is attractive to vacation goers. Think about getting something about 15 mins from the beach or close to popular entertainment districts. Your rental will generate more income if it’s in a popular location with vacation goers.

Make a list of all your must-haves when searching for your property. Don’t rush into something that you may not be happy with in the future. Ask lots of questions and take notes. If you need help with finding your property I am available to help you with buying or selling your property. Contact Arona at 727-422-9340.

Many of us think that the best time to sell a home would be in the spring and summer. This is true that the majority of buyers are looking to make a purchase during those months. But not all buyers disappear after Labor Day.

In Florida, your home may get a lot of interest from all the snow birds that are flocking down to Florida. This is a great time to take advantage of the holiday season and show off your home to 2nd home buyers or buyers that are looking to make Florida their home.

This is a great time to make your home look cozy and family friendly. Most people shopping for homes during the holidays are very motivated. This is great time to capitalize on this by creating an atmosphere of family with tasteful decorating and minimal clutter.

Show off your home’s greatest assets and enhance it by using tasteful christmas decorations.

Many sellers are debating on taking their home off the market during the holidays. You may find that you have little or no competition during the holidays. New sellers may want to wait for the new year to list their home or prefer to get it ready for sale during spring or summer.

This is an advantage to you because you have less competition for buyers looking for homes like yours. When you have less homes on the market it means that you get tons of buyers focusing on your home. Talk to your realtor and make sure your home is priced correctly.

Most people don’t decide to move during the holidays. If you have a buyer shopping for a home during the holidays usually it means they have to move. This involves a job or other reason to buy a home during the holidays. People shopping for homes around the holidays tend to be serious buyers and are very motivated. Keep the holiday cheer on when you meet with these folks and you’ll be sure to sell your home.

In order to use an FHA loan to purchase a home, the property will have to be appraised and inspected by a HUD-approved appraiser. This is to ensure that the property meets HUDS’s minimum property standards.

WHAT IS AN APPRAISAL?

Only an expert can assesses or determine the value of your home. You get an appraisal to determine the value of your home in today’s market. The appraiser usual has a check list of HUDs requirements for FHA.

Things You Should Know About FHA Home Appraisals

These are just some of the things that will be addressed with an FHA Appraiser. To get more information visit FHA APPRAISAL

If you are looking for more information on selling or buying a home please call/text 727-422-9340 or email: arona.mcginley@gmail.com or fill out the contact form.

Have a talk with your bank / lender and get one of these.

1. Pre-Qualification Letter

2. Pre-Approval Letter

3. Loan Commitment

Talking to your bank/lender gives you an idea of how much house you can actually afford. Once you start looking for your home you don’t want to waste time on looking at homes that you cannot afford. It can be very emotional when you’ve found your dream home then you find out you cannot afford it. By talking to your lender you can get advice from a professional as to whether or not you qualify for any home buyer programs or loans.

Notes

What is a Pre-Qualification Letter?

A pre-qualification letter says what’s the maximum a buyer can pay for a home. However, it relies only on truthful but non-verified verification. This is an informal estimate and the information can be done by telephone, email, online or in person.

What is a Pre-Approval Letter?

A pre-approval letter provides documentation of exactly how much mortgage the borrower have been approved to borrow. This is based on the borrowers income, assets, debts and credit. This is more detailed than a pre-qualification letter and it involves verification of data and underwriting. A pre-approval letter can make a big difference for home buyers, it shows the sellers that you are very serious about buying their home.

What is a Loan Commitment?

This is when the buyer does full on loan application and this can be completed in person or by mail. The lender will need the borrower’s income, assets, debts and all credit is considered. The bank will need verification of employment, bank statements and verification of deposits and any other form of income or debts the borrower may claim to have.

It’s pretty much an American dream to own your home. It gives you peace of mind to know that you have something that is truly yours and a place that you can raise your family.

Many of us are intimated by the idea of owning their own home. It means more responsibilities that come with owning your home as well as the daunting process of finding the home, getting a mortgage and closing on the home. Owning your own home is an investment on your future and can save you tons of money. Basically if you’re renting then you are paying someone else’s mortgage. You do not get a return on investment when you rent.

Benefits of owning your own home

There are so many other reasons to own your own home. Whatever your reason is, it is worth it to invest in your own home.

For more information on the real estate market in the Tampa Bay Florida area contact your local realtor Arona McGinley – 727-422-9340 or arona.mcginley@gmail.com.