Are you thinking of buying a second home or an investment home?

Why Should you Invest In Florida?

Florida is listed as the number one vacation destination. If you have extra cash this would be a great place to invest in a second home or even a home that you can rent out and make some extra cash.

There are many reasons that Florida is so attractive

- The lifestyle of Florida is an attraction to people living up north. You can enjoy outdoor activities all year round, and even hang out at the beach in December.

- Waterfront properties are accessible to buyers looking for that water view. You can invest in condos, townhouses, and single-family homes. This is something that can be an advantage if you decide to rent out your home to vacation goers. There is a strong demand for rentals close to the water.

- Florida is a very popular vacation destination. Whether you are vacationing with your family or you’re single, there is something for everyone here. Buying a home and renting it out when you’re not using it, can give you some extra income. There are many property management companies that can take care of all the day to day services for a very reasonable fee.

- Here in Florida property taxes is slightly lower than many other states. This depends on what county or city you may decide to purchase your home.

Finding The Right Property in Florida

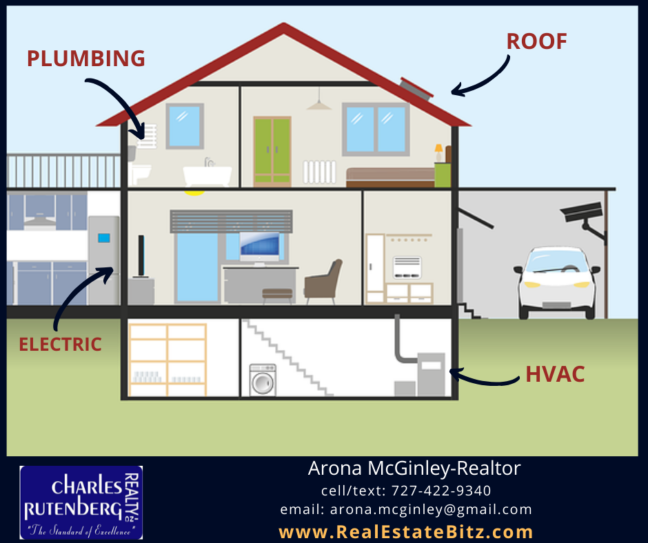

When considering to purchase your home you will first have to consider what is your intention or the purpose of this home. If you are a snowbird then you will be using your Florida home during the winter months, and you can rent it out during the summer to friends, family or vacation goers. Are you planning on using a maintenance company to oversee everything? Is the income from the rental important, for example, will it be helping to pay the mortgage. These are things you will want to consider if you plan on using your home as a rental.

Some counties and cities have certain rental restrictions. Consider these rental restrictions when searching for an investment property. Some areas have restrictions such as rental agreements that can be no less than 30 days. These restrictions can affect how much rental income you can earn.

If this is an investment property you want to consider a location that is attractive to vacation goers. Think about getting something about 15 mins from the beach or close to popular entertainment districts. Your rental will generate more income if it’s in a popular location with vacation goers.

Make a list of all your must-haves when searching for your property. Don’t rush into something that you may not be happy with in the future. Ask lots of questions and take notes. If you need help with finding your property I am available to help you with buying or selling your property. Contact Arona at 727-422-9340.